capital gains tax rate 2022

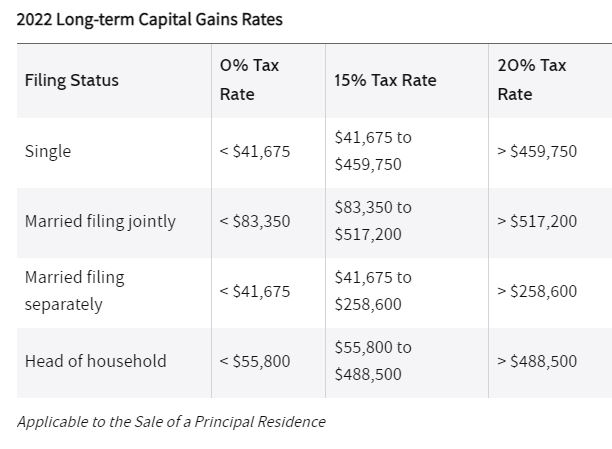

If you sell stocks mutual funds or other capital assets that you held for at least one year any gain from the sale is taxed at either a 0 15 or 20 long-term capital gains tax rate. The rates are much less onerous.

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Avoid Capital Gains Tax on Real Estate in 2022.

. 2 days agoThats about 15 of all UK tax receipts. 1706 shall be filed and paid within thirty 30 days following the sale exchange or disposition of real property with any Authorized Agent Bank. Long-term capital gains tax rates typically apply if you owned the asset for more than a year.

First deduct the Capital Gains tax-free allowance from your taxable gain. If your income grew by 5 2000 in 2023 your 2023 tax income of 42000 would bump you up to. The Guide to capital gains tax 2022 explains how CGT works and will help you calculate your net capital gain or net capital loss for 202122 so you can meet your CGT.

1 day agoThe rate at which you pay Income Tax denotes which rate you pay for Capital Gains Tax. Some or all net capital gain may be taxed at 0 if your taxable income is less than or equal to. Theyre taxed at lower rates than short-term capital gains.

Make investments in Isas as any gains are tax-free. Short-term gains are taxed as ordinary income based. Depending on your regular income tax bracket your.

Rates would be even higher in many US. Based on filing status and taxable income long-term capital gains for tax year 2022 will be taxed at 0 15 and 20. Mr Osborne the chancellor then decided to increase capital gains tax bringing in a new rate of 28pc for.

Rates of capital gains tax range from 10 to 28 depending on the income of the taxpayer and the type of asset sold. 2022 Long-Term Capital Gains Tax Rates. Long-term capital gains are gains on assets you hold for more than one year.

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. Long-term capital gains are taxed at the rate of 0 15 or 20 depending on a combination of your taxable income and marital status. The Capital Gains Tax Return BIR Form No.

For single tax filers you can benefit. The top federal rate on capital gains would be 434 percent under Bidens tax plan when including the net investment income tax. There is currently a.

35 Trillion Spending Package Update Under the Biden-Democrat social infrastructure plan long term Capital gains tax rates could increase to 25 from 20 for. From April 2022 the dividend tax. 7 rows In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above.

The income brackets are adjusted. CGT is expected to raise 15bn in 2022-23 or 15pc of all receipts. Add this to your taxable.

The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. The long-term capital gains tax rates for the 2022 and 2023 tax years are 0 15 or 20 of the profit depending on the income of the filer. The tax rate on most net capital gain is no higher than 15 for most individuals.

Tax filing status 0 rate 15 rate 20 rate. Includes short and long-term Federal and State Capital. Heres a peek at the 2022 short-term capital gains rates for those who break up with their stocks early.

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds Marca

What Is The Capital Gains Tax How Is It Calculated And How Much Will You Pay Kiplinger

What You Need To Know About Capital Gains Tax

2022 Capital Gains Tax Rates In Europe Tax Foundation

Capital Gains Full Report Tax Policy Center

Minimizing The Capital Gains Tax On Home Sale Bubbleinfo Com

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

When To Sell Tdf In Brokerage Account Bogleheads Org

The Tax Impact Of The Long Term Capital Gains Bump Zone

Short Term Vs Long Term Capital Gains White Coat Investor

2022 Capital Gains Tax Rates Mullooly Asset Management

2022 Income Tax Brackets And The New Ideal Income

2022 Capital Gains Tax Rates By State Smartasset

2022 Income Tax Brackets And The New Ideal Income

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

2022 2023 Capital Gains Tax Rates Calculator Nerdwallet

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains